2026 Salary Survey by company size and metro area

Growth of Salaries for IT Pros slows - 1.67% for last 12 months

Order Salary Survey Download Sample

IT compensation does not keep up with inflation and hiring slows but still strong

The 2026 IT Salary Survey by company size and metro area is available for immediate download. Janco has conducted salary surveys of the IT Job market for over 40 years. The data from this survey has been published in the Computer Industry Almanac, The Wall Street Journal, The New York Times, eWeek, and many other business and industry publications. In addition, over the years, it has been featured on CNN, the Wall Street Journal, and several national and international television and multi-media outlets.

Updated with the latest data

Latest YTD IT job market data - Subscribe to our Newsletter to get this information delivered to your inbox as soon as it is released. SUBSCRIBE

IT Salaries were on the rise. More companies were investing in information technology. The emphasis over the past several years is in both e-commerce and mobile computing. At the same time with the ever-increasing Cyber attacks and data breaches, CIO are looking to harden their sites and lock down data access so that they can protect all of their electronic assets.

Added to that in an ever-increasing array of mandated requirements from the EU with GPDR and US federal and state requirements to protect individual users' privacy. All of these factors increase demand for experienced IT Pros and salaries they are paid.

Added to that in an ever-increasing array of mandated requirements from the EU with GPDR and US federal and state requirements to protect individual users' privacy. All of these factors increase demand for experienced IT Pros and salaries they are paid.

The salary survey is updated twice a year; once in January and then again in July. Janco and eJobDescription.com not only look at base salaries, they also report on total compensation. How survey is conducted is described here.

Order Salary Survey Download Sample Provide Data

You can get a free copy of the full survey if you provide 10 valid data points and use a corporate e-mail address. Free e-mail accounts like gmail or yahoo do not qualify as we have no way to verify the accuracy of the data provided.

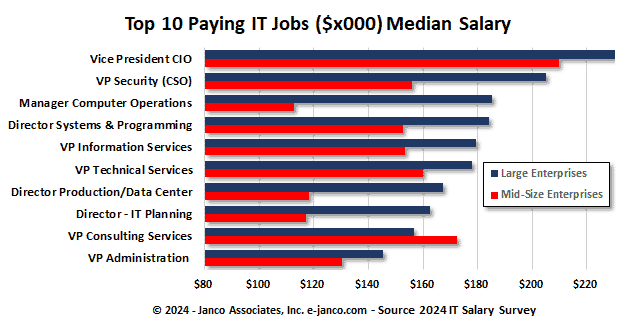

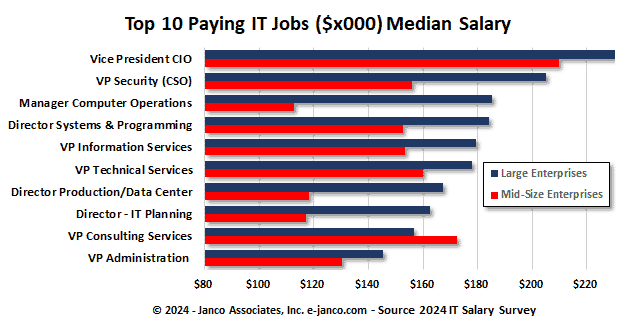

Top Paying IT Positions

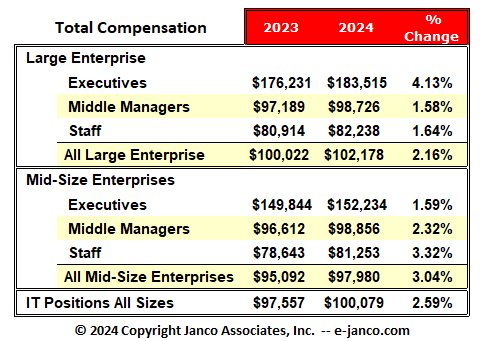

Large enterprises tend to compensate IT Professionals more than SMBs. The top 10 paying execeutive jobs are shown in the chart below. The only position that is paid more in mid-sized enterprises is that of Vice President Consulting Services.

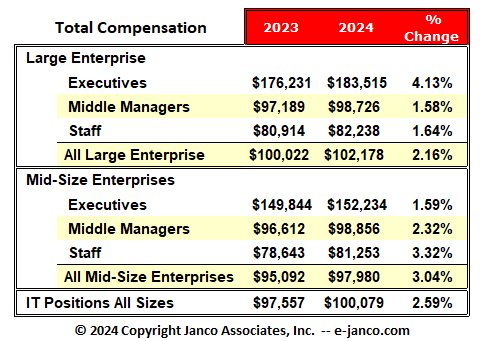

Salary Survey Summary

Are you paying too much or too little to your IT staff? Do you have IT job descriptions? Are you earning what you're worth? Whether employer or employee, it is important to know what other companies are paying in total compensation for a similar position in your area. Learn how your company compares in the area of compensation. Data is as of June 2025.

Summary Findings

Two Artificial Intelligence positions were added to theIT Salary Survey. They are the Vice President Artificial Intelligence (aka Chief AI Officer CAIO) and Project Manager Artificial Intelligence. Dropped from the survey were the Supervisor Word Processing/Data Entry and the Data Entry Operator. Many of those positions have been eliminated with recent Office Automation, e-commerce, and artificial intelligence. As a result, there is insufficient data to analyze, and is why those positions were dropped.

Our observations for the 2026 IT Salary Survey are as follows:

If you do not want to purchase the full salary study, you can get just the data (as of January) for a particular city for a fraction of the cost of the full study.

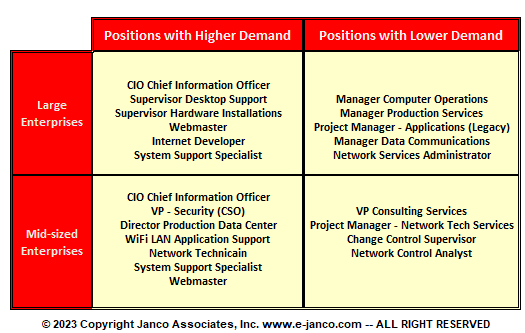

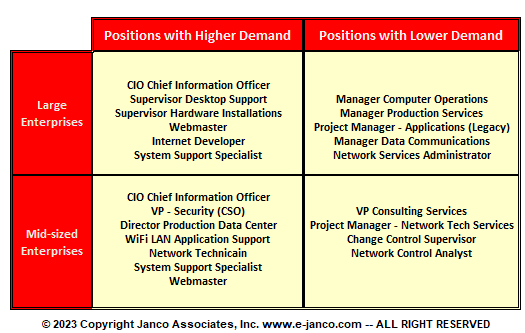

IT Positions in Demand

Hiring prospects are looking good for IT Professionals. Many enterprises are looking expand the size of the IT function as the economy continues to recover and application development increases along with the use of contractors and consultants.

Current IT Hiring Plans - IT Job Hiring Picture Spotty

With the move towards Artificial Intelligence, the treat of an economic downturn, tariffs, inflation, high energy cost, and the continued wars will continue dampen hiring for IT pros over the next few quarters. Subscribe to our Newsletter to get this information delivered to your inbox as soon as it is released. SUBSCRIBE

Based on Janco's interviews and survey data the following positions are in high demand.

Updated with the latest IT Salary Survey Data see IT Salary Survey post pandemic

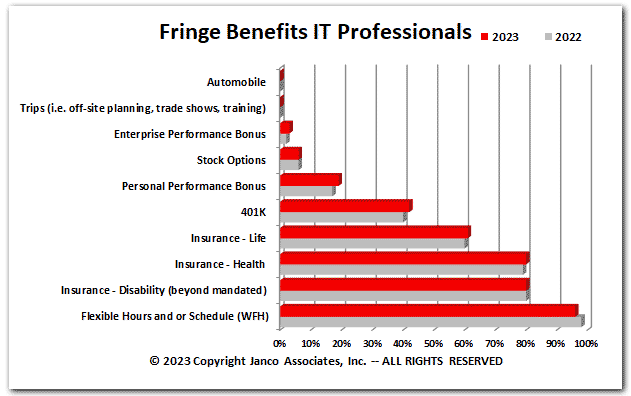

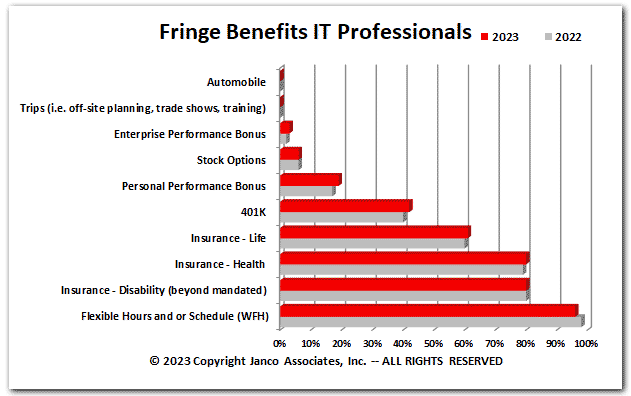

Fringe Benefits for IT Professionals

Companies have started to adjust the fringe

benefits provided to IT Professionals. A full

historical comparison of trends in benefits is included with the

full version of the Janco IT Salary Survey.

Fringe Benefit Historical Trends

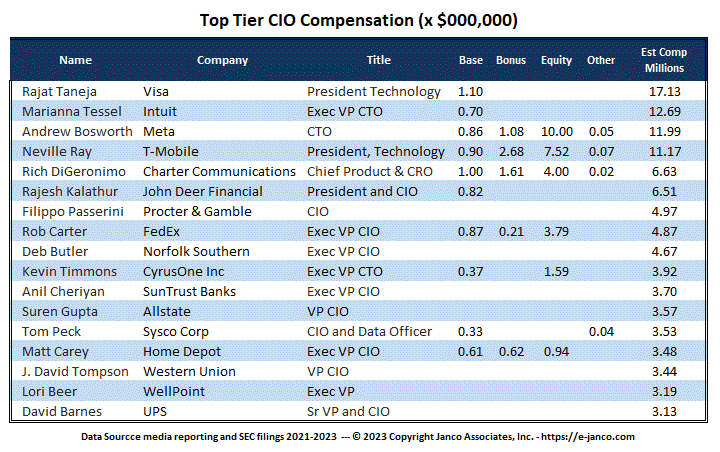

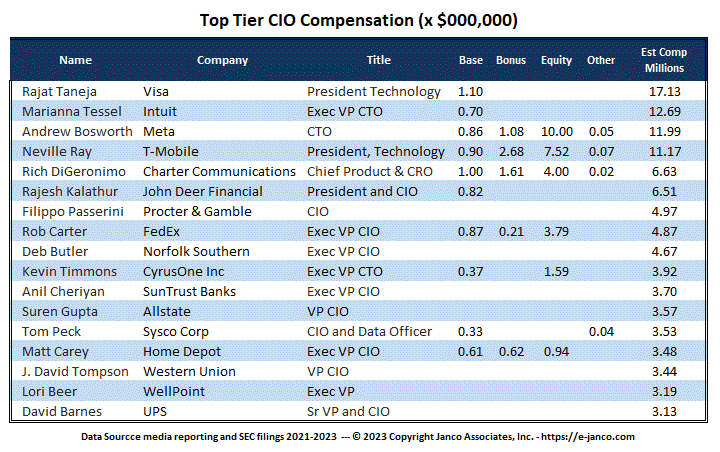

Top Paid CIOs

The top compensation for highest paid CIO is over $21 million and that is for Michael Schroepfer at Facebook. Most of his compensation is tied directly to the stock of his company. From public data we have found that there at least 25 CIOs who's compensation $2 million and above.

The average total compensation for the top 36 highest paid CIO for the year ending 12/31/2022 was well over $2 million with a base salary average of $550K. The balance of compensation came from bonus, stock, options, and pension programs.

Read on CIO Job Description Order CIO Job Description

IT Job Market Size

The IT job market now includes 3.9 million individuals. These are all high salary positions and critical to US economy.

Updated with Latest Data

Subscribe to our Newsletter to get this information delivered to your inbox as soon as it is released. SUBSCRIBE

Historic IT Job Market Size

Data complied by Janco Associates with data as of Jamuary 2026

Subscribe to our Newsletter to get this information delivered to your inbox as soon as it is released. SUBSCRIBE

Order Salary Survey Download Sample Provide Data

If you provide ten or more job title data points you will qualify to get a free copy of the full study. If you have any questions on the survey send us an e-mail at

Janco Associates

Added to that in an ever-increasing array of mandated requirements from the EU with GPDR and US federal and state requirements to protect individual users' privacy. All of these factors increase demand for experienced IT Pros and salaries they are paid.

Added to that in an ever-increasing array of mandated requirements from the EU with GPDR and US federal and state requirements to protect individual users' privacy. All of these factors increase demand for experienced IT Pros and salaries they are paid.