Potential Impact of Proposed Taxes on IT Job Market

Increased Federal Budget Deficit and Inflation Will Impact IT Job Market

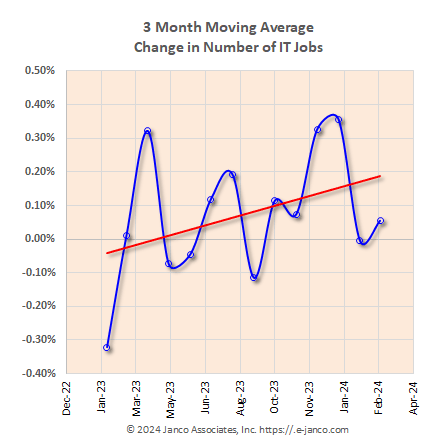

For the past several years Janco has provided a monthly forecast on IT job market growth. The basis of that forecast is interviews with CIOs and other C-level executives, BLS employment data, several economic forecasts and consumer confidence.

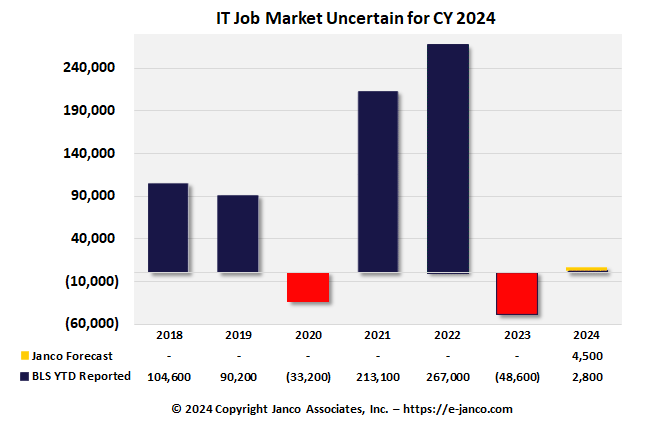

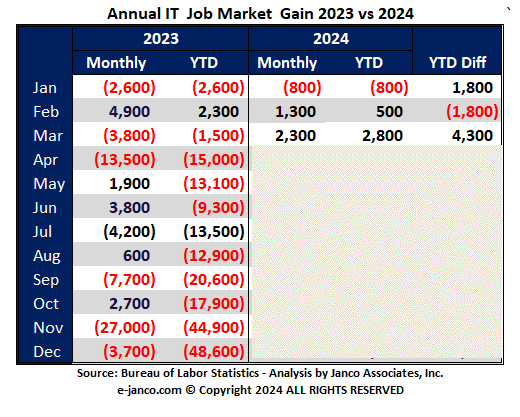

IT Job Market Flat for FY 2024

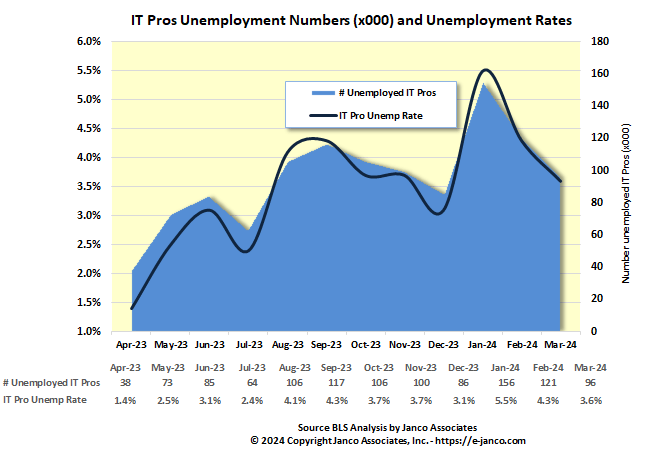

There now are approximately 96K unemployed IT Professionals. The IT job market shrank by over 48,600 jobs in CY 2023. Overall that is a flattening of the long term growth rate pattern of IT job market.

Data complied and forecast updated by Janco Associates with data as of April 2024

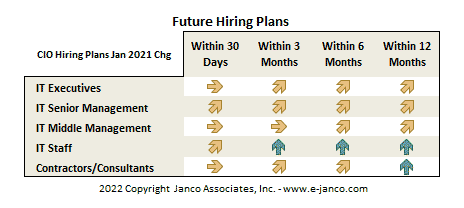

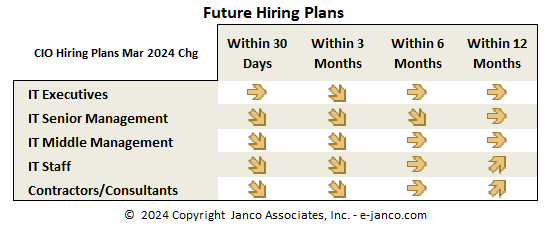

CIO Hiring Plans (updated)

Updated with the latest information

In a few short months gas pump prices have gone up over a dollar a gallon with the reduction of drilling and fracking on federal lands. At the same time, the US is moving back towards the need to import oil from energy independence.

Currently, the forecast for inflation is at almost 3% by the end of the 4th Quarter of 2021. Much of that is due to higher fuel cost (transportation and utility cost impact) from the shut down of drilling and fracking on federal lands and the increased money supply from the deficit caused by the two existing Covid relief bills.

Add to that the proposed increases in taxes, we soon may have an economy like Jimmy Carter's. A great study authored by two Rice University economists (John W. Diamond and George R. Zodrow calculated the effects of the proposed taxes below:

- Corporate tax rate increase from of 21% to 28.

- Corporate alternative minimum tax reinstatement

- Expensing (100% bonus depreciation) of most investments in depreciable assets immediate elimination rather than phasing out over 2023 - 2027 and replacement with the modified accelerated cost recovery system.

- 20% deduction for certain pass-through business income is immediate repeal, rather than expiring in 2026.

- Capital gains and dividends taxed at the same rate as ordinary income for taxpayers with incomes above $1 million

- Unrealized capital gains are taxed at death

- Top individual tax rate increased immediately from its current level of 37% to its pre-TCJA level of 39.6%, rather than expiring in 2026.

They found that the U.S. would lose one million jobs in 2022 and 2023 (50K - 75K IT jobs), GDP would be $117 billion lower by 2023, and ordinary capital, or investments in equipment and structures, would be $80 billion less in 2023.

NAM (National Association of Manufacturers) President and CEO Jay Timmons summarized the studies findings:

“... with 2017 tax reforms: we raised wages and benefits, we hired more American workers, and we invested in our communities. If we undo those reforms, all of that will be put at significant risk. Manufacturing workers will lose out on jobs, growth, and raises. ...But the conclusion of this study is inescapable - follow through with tax hikes that give other countries a clear advantage and we’ll see far fewer jobs created in America.”

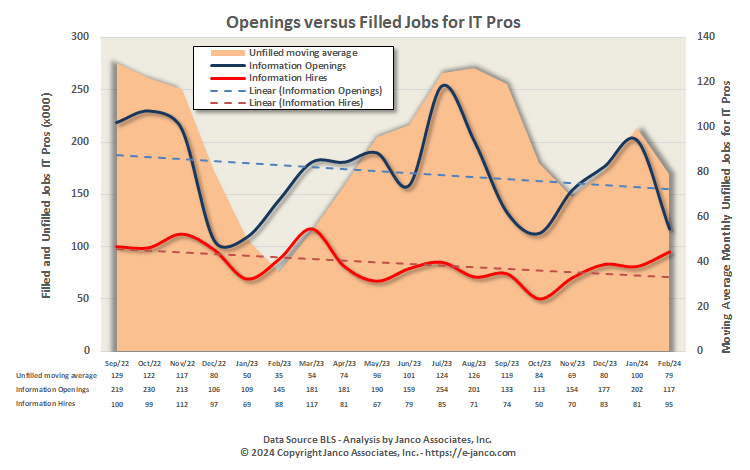

This will result in a reduction in the number of IT jobs. Below is chart that presents IT job market growth for the last current year and last year.

Latest YTD IT job market data - IT job Market Growth in Q1 2024 out performs Q1 2023